Spin Cycle: How Recessions Reshape Talent Acquisition Strategies

Remember 2021? When a carton of eggs cost $1.27, the Weeknd was still relevant enough to land the Super Bowl halftime show, X was called Twitter, people under 50 still used Facebook and Q was still making drops? I know, it seems like a fever dream to me, too – those halcyon days of headcount hyperscaling.

Back then, signing bonuses outpaced salaries, every recruiter had “hypergrowth” in their LinkedIn headline, a technical sourcer with a couple years of experience could pull in close to 200k at the FAANG company of their choice, and HR Tech vendors were busy convincing us that their new AI solutions were going to end candidate ghosting and improve the candidate experience?

Good times.

Then reality, as it tends to do, showed up like a hiring manager at mandatory “unconscious bias” training (another 2021 relic): late, annoyed, and ready to blame everyone else. Economic indicators slowed. Earnings slipped. Budgets got slashed. And suddenly, recruiting, once the belle of the boardroom ball, was back to being the redheaded stepchild of the cost center family.

If the last recession taught us anything, it’s this: recruiting is the first to get cut and the last to get forgiven. But it also taught us that recruiting, if anything, is not only resilient – it’s also down times that determine who wins (and who loses) the war for top talent when, inevitably, the next upswing occurs.

Let’s get one thing out of the way: “People are our greatest asset” is only true until the stock price dips. Then, magically, people become liabilities on a spreadsheet.

Case in point: during the 2022–2024 “correction,” which is a term labor economists use for “overspending on talent,” U.S. companies laid off over 300,000 tech workers. In most of those cases, talent acquisition teams were hit first. Not because they weren’t performing—but because they weren’t generating revenue, at least not in the eyes of finance.

And this isn’t just anecdotal. According to a Harvard Business Review analysis, companies that conduct mass layoffs during downturns often suffer long-term damage in productivity, morale, and even profitability. But those consequences don’t appear in quarterly earnings reports, so they get ignored.

Recessions: A Recruiting Reality Check

Let’s stop for a minute and address the elephant in the boardroom: is this even a real recession? Depends on who you ask (and what metric they’re cherry-picking).

The job market has become the ultimate Rorschach test for the economy. Technically, GDP growth remains positive and the U.S. hasn’t entered a formal recession, at least not by the traditional two-consecutive-quarters definition.

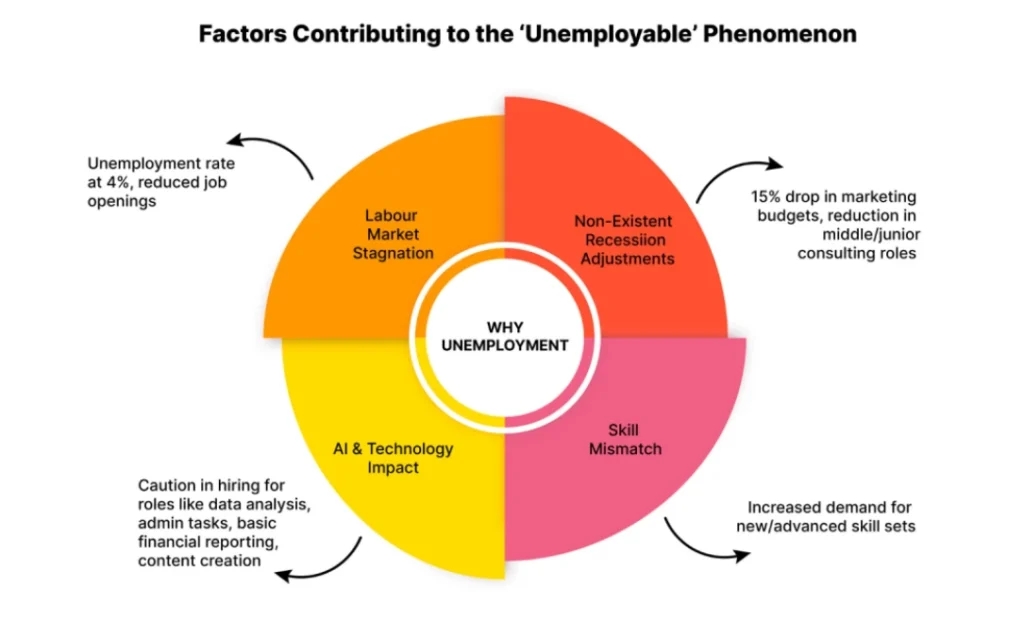

But for recruiters and HR leaders, it sure feels like one. And that’s because we’re in what economists are calling a “richcession” – a labor market slowdown concentrated among white-collar, professional, and tech workers. You know, like HRBPs or corporate talent acquisition professionals.

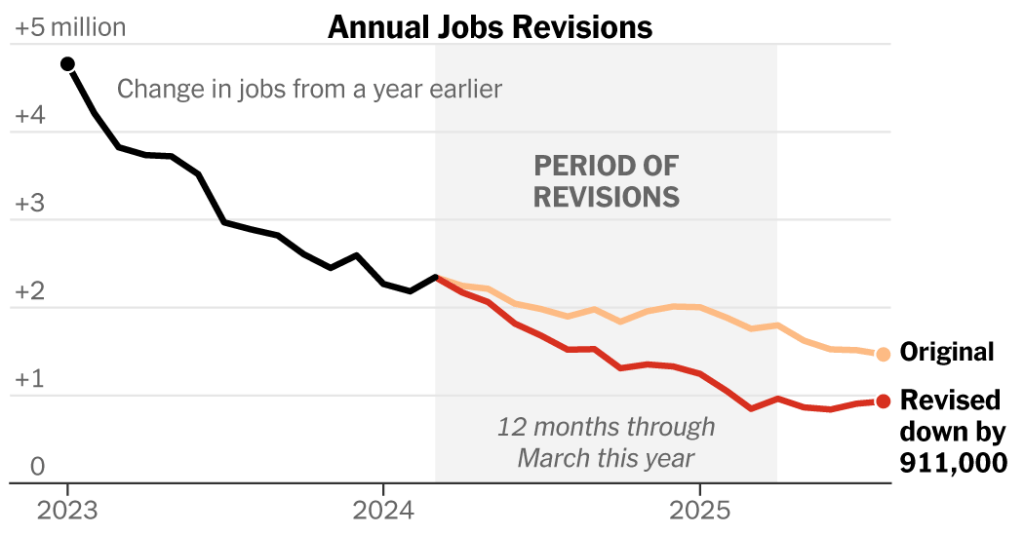

While the U.S. added 187,000 jobs in August 2025 (a figure that’s certain to receive a significant downward revision shortly), according to Bureau of Labor Statistics data, nearly all of that growth came from healthcare, government, and hospitality. Professional and business services (where most corporate recruiters live) shed over 60,000 jobs this year, marking a continued contraction in sectors that had previously driven headcount booms.

Then September hit – and with it, for the first time in a long time, the U.S. economy lost more jobs than it created, according to today’s ADP Jobs Report, released in advance of the BLS’ official numbers, but often far more accurate, that showed a net loss of around 32,000 last month.with losses being led, again, by the same sectors and functions in which human resources practitioners and people leaders are disproportionately concentrated.

In other words, the blood bath is just beginning, but it’s getting worse, and quickly.

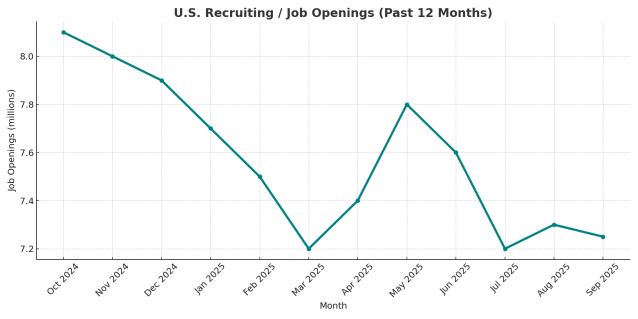

Unemployment, at 4.1%, is still historically low. But that stat hides a more interesting trend: the number of job openings has fallen below 8.5 million for the first time since 2021, while the number of hires and voluntary quits are also declining. That’s not just cooling—it’s calcifying.

A 2025 report shows that postings for tech and marketing jobs are down over 40% year-over-year, even as demand for logistics and caregiving surges.

So yes, we’re growing. But we’re not growing everywhere. And recruiters who were built for scale are now being forced to learn how to shrink strategically.

Recruiting Efficiency: Move Slow and Save Things

In boom times, every hiring delay is a catastrophe. In a recession? It’s a strategy. Suddenly, hiring slowly becomes “being thoughtful.” Lower offer acceptance rates become “rigorous standards.” Recruiters who used to boast about time-to-fill now talk about pipeline quality and “calibrated expectations.”

In other words, it’s all just efficiency theater.

This is especially true when teams shrink. According to a LinkedIn Talent Trends Report, over 48% of recruiting teams reported operating with significantly reduced headcount as of mid-2024. But job postings still needed to be closed, reqs still had to be cleaned, and performance dashboards still had to be faked. er, “refreshed.”

So we stop being proactive. We start reacting. And we tell ourselves it’s all part of a larger workforce strategy, not just budget triage in a blazer.

And let’s not forget that ubiquitous HR Tech stack. During economic expansion, every CHRO becomes a target for SaaS creep; an endless parade of AI-powered sourcing widgets, culture dashboards, and “skills intelligence” platforms that somehow cost more than your entire intern program.

In a downturn? It’s consolidation season.

According to Gartner, 75% of enterprises will have consolidated their HR tech stack by 2026, up from just 15% in 2021. Which means every vendor you bought during the sugar rush of hypergrowth is now scrambling to rebrand as essential.

That “interview intelligence” platform you bought last year to impress your CEO? It’s now a workforce optimization tool. The “DEI analytics suite” you piloted for HR? Now it’s magically a “skills mobility engine.”

Everyone’s a talent intelligence company in a recession, especially if they’re trying to justify renewals.

What A Req: The Regression of Recruiting

Remember when recruiters had specialties? There were sales recruiters, finance recruiters, marketing recruiters, executive recruiters, the list goes on. Hell, university relations/campus recruitment and diversity sourcing were not just viable, but in demand, too.

In a recession, all recruiters become generalists again – scrubbing pipelines, cleaning up reqs, and mopping up the mess from rushed layoffs and chaotic reorgs.

And we’re expected to hit our KPIs while doing it, keep our mouths shut and our heads down – lest we become candidates, too. In a recession, there’s no scarier place to be. Recruiters know this – which is why the focus always shifts from innovation to preservation at the first sign of a downturn.

A SHRM survey from Q2 2024 found that 64% of recruiters reported handling more than double their pre-downturn req load. At the same time, job quality declined, candidate engagement plummeted, and ghosting reached all-time highs, especially in sectors like healthcare, retail, and hospitality.

Bad news: You’re no longer a strategic partner. You’re no longer a trusted advisor.

Your Employer Brand Is Built During A Downturn

When hiring slows down is where talent acquisition picks up most of its actual organizational value – and companies should view these coming months not as a challenge or threat, but, instead, as a competitive advantage.Recession-era recruiting isn’t sexy, but it’s strategic.

It forces real conversations about:

- Which roles actually matter: A McKinsey study found that 5% of roles in most organizations drive 95% of business outcomes. If you don’t know which ones those are, now’s a good time to find out.

- What skills are future-proof: According to the World Economic Forum, over 44% of workers’ core skills are expected to change within the next five years. That means what you’re hiring for today might already be obsolete by the time they finish onboarding.

- Who is worth fighting for: Layoffs tend to cut by cost or tenure, not by impact. A recession is the perfect time to audit your top performers—and your biggest bottlenecks.

When times are good, you can get away with a lot of branding fluff. In a downturn, candidates pay attention to how you treat employees. A Pew Research survey in late 2023 showed that 43% of U.S. workers felt less trust in their employer following layoffs or restructuring—regardless of whether they were directly affected.

Layoffs are sometimes necessary. But how you execute them? That’s your brand. And candidates have longer memories than your chief marketing officer.

According to a 2024 Deloitte report, 82% of high-performing organizations now use real-time labor market data to inform their headcount plans and skill forecasting.

The recruiters who survive this downturn won’t be the ones who just fill roles—they’ll be the ones who understand the business. Who know how to read a P&L. Who can forecast headcount better than the VP of finance. Who can tell the difference between a sourcing funnel and a vanity metric.

You want to keep your job?

Start thinking like a consultant. Not a coordinator. Be an enabler. Not a gatekeeper. And never forget, you’re only one bad business decision away from being a candidate, too – so show a little empathy and humanity to your people, too. AI sure as hell can’t.

And Now, Some Good News.

This was, admittedly, a horribly depressing and cynical post. But if you’re looking for silver linings, here’s the thing about recessions: they inevitably end.

A recent Brookings Institution report noted that companies who maintained internal mobility programs and talent planning during downturns experienced 28% faster revenue growth post-recovery than those who didn’t.

The smart TA teams aren’t scaling back; they’re tightening up. Cleaning their data. Evaluating their stack. Building pipelines. Re-recruiting internal talent before they become attrition statistics.

Because the rebound will be violent. The second the market shifts, every company that downsized will be hiring again, and paying top dollar to fix the damage they did by “optimizing headcount” in 2025. Which is good news for sourcers with zero experience but who live near a BART station, honestly.

Recession recruiting isn’t glamorous. It’s not even fun. But it’s where reputations are built, skills are sharpened, and real value is created.

And if nothing else, it’s a great time to update your deck on “recruiting as a strategic business partner.”

You’re going to need it. Again. And sooner than you think.

Pingback: Unplugged: Insights from a Decade of RecFest | Snark Attack

Pingback: AI or Alibi: Judgement Day for Knowledge Workers? | Snark Attack

Pingback: Buzzwords in Recruiting: A Survival Guide for 2026 | Snark Attack

Pingback: Talent Acquisition Trends to Watch in 2026 | Snark Attack