Winston Goes to Walldorf: SAP Acquires SmartRecruiters’ AI and Ambition

Here’s a headline I didn’t expect to write this year (or ever, if we’re being honest). But it’s true.

SAP is acquiring SmartRecruiters.

And for once, in a sea of misguided “strategic tuck-ins” and overpriced AI fluff, this actually makes sense. For everyone.

Candidates. Recruiters. SAP. Hell, even SuccessFactors might finally be able to recruit without a manual.

This isn’t one of those acquisitions where a flailing legacy platform absorbs a scrappy little startup and slowly strangles the innovation out of it.

If SAP plays this right, it could actually turn the recruiting tech market on its head—and maybe, just maybe, fix the trainwreck that is enterprise hiring in the process.

And in what might be a first for HR tech, SmartRecruiters seems to have pulled off the rarest of moves: getting acquired without selling out.

CEO Rebecca Carr (my former boss, who I’m so happy for, and without whose return to the company today’s news likely wouldn’t have happened) didn’t mince words in her announcement:

“We remain fully open and agnostic. SmartRecruiters will continue to integrate across ecosystems, giving you flexibility and freedom to build the recruiting stack that works best for you.”

In other words: SmartRecruiters didn’t sell out. They scaled up.

It’s a bold promise, to be sure, especially coming from a company that just signed its soul over to an ERP giant known for turning product roadmaps into labyrinths of integration middleware and “go-lives” that somehow take longer than to implement than a new Grand Theft Auto game or a Hunger Games prequel.

So. What the actual hell is going on here? Why did SmartRecruiters sell now? What does SAP get out of it? And is this the rare M&A deal that actually makes the industry better?

Let’s break it down.

SaaS and Schaudenfraude: Why SAP Bought SmartRecruiters

Let’s start with SAP, unsere deutschen Freunde. They’ve been selling an “enterprise ready” applicant tracking system for years, positioning SuccessFactors as an integral part of its core HCM offering since its acquisition way back in 2011 (in product marketing, if not in reality)..

So why add another ATS to their already somewhat bloated portfolio of misfit platform plays (see: Ariba, Fieldglass, or at some point, Qualtrics)?

In this market, if you’re a company with the risk profile of SAP, you don’t pay enterprise prices for recruiting software unless you’re either (a) really desperate or (b) finally ready to take recruiting seriously.

SAP, from the looks of things, is both.

SuccessFactors may be fine for performance reviews, comp cycles, and forcing people to take mandatory cybersecurity training, but when it comes to recruiting?

The platform has long been the minivan of legacy applicant tracking systems: it’ll get you there, eventually, but no one’s ever excited to drive it. When there’s no roadmap, it’s really easy to get lost, which is, effectively, what SAP has been telling enterprise TA buyers for the past decade or so.

In the fight for market share and EPS, SAP seeingly had two choices: build something from scratch (see: impossible with this engineering team’ or buy something best-in-class and slap a halo around it.

Enter SmartRecruiters—a company that actually understands what recruiters do, and somehow built a platform that doesn’t actively make their lives worse.

As SAP board member and head of product engineering Muhammad Alam said in the official announcement:

“Adding SmartRecruiters to our portfolio delivers on our commitment to help our customers attract, hire, and retain the best talent. SAP will continue to invest in innovation to help CHROs and HR teams meet today’s most pressing talent challenges.”

Translation: we finally realized recruiting is the front door of the employee experience, and we couldn’t keep pretending our existing solution was good enough. Or at least that’s what Chat GPT clearly told the PR person responsible for drafting this release.

For real, though: this isn’t just a “fill the product gap” move. It’s SAP making a bet that AI-powered, experience-driven recruiting is going to be table stakes in the future of HCM – and they want to own that table.

Why SmartRecruiters Sold (Hint: It Wasn’t for the Logo)

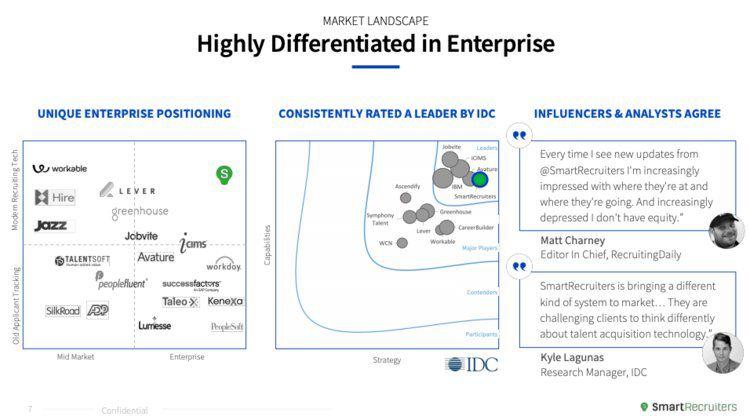

At first glance, SmartRecruiters selling now might seem counterintuitive. They’ve raised over $115 million, built a customer base that includes LinkedIn, Visa, Equinox, and McDonald’s, and had a well-earned reputation as one of the last real product-led innovators in the recruiting tech space.

So why sell?

Three words: IPO market sucks. Four more: They were already overvalued.

With tech valuations still sluggish across the board, venture capital tightening, and SaaS IPOs underperforming like a Robert Half recruiter on a contingency search, the dream of a public exit lost a lot of its sparkle.

Staying private meant raising another mega-round – or worse, settling for a growth equity deal with more strings than an orchestra.

Selling to SAP? That’s cash in the bank (and Euros, at that), a platform for growth, and an escape from the endless “what’s your CAC:LTV ratio” interrogations of late-stage fundraising.

Carr put it more diplomatically:

“This next chapter gives us the scale and resources to deliver [Hiring Success] faster and more powerfully than ever before.”

Translation: we wanted to keep building, and finally get some cash from all this equity – not burning more time and good will begging VCs for runway.

And let’s be honest: there’s only so long a company can go being the “cool ATS” before their investors start asking uncomfortable questions about margins, CAC, and exit timelines. SAP offers exactly what SmartRecruiters needed to break out of the mid-market echo chamber and go fully enterprise, without losing control of their product.

So yeah, they sold. But they didn’t fold.

Sprechen Sie Nicht: What The Announcement Left Out

Let’s address what the announcement conspicuously omitted: no deal terms were disclosed.

No valuation. No multiple. No victory lap.

Which either means SAP paid a number so absurdly high that no one wanted to say it out loud, or (more likely) the valuation was good, not great, and everyone involved is happy enough to move on without a TechCrunch headline screaming “RECRUITING UNICORN CASHES OUT.”

What we do know is that SAP’s last major HR tech acquisition, SuccessFactors, cost them $3.4 billion in 2011. And SmartRecruiters isn’t SuccessFactors scale. Yet.

So while the number was likely solid, it was probably far more strategic than financial. In other words, this wasn’t about revenue multiples. This was about relevance.

SAP saw a fast-moving platform with 4,000+ customers, real AI, and actual user love, and they decided it was easier to buy it than to keep pretending they had anything comparable.

Ashby’s recently announced raise, likely coming, in a complete coincidence, during final deal sheet negotiations, also sent out a strong market signal validating the continued viability and profitability of the applicant tracking system market – and likely gave both sides a strong inducement to come to agree to terms.

After all, for SAP, the Ashby funding news provided a pretty salient business case for the potential market and shareholder value creation represented by adding a top ATS like SmartRecruiters to their portfolio.

And, of course, there’s always the fear (in this case, likely justified) that any company actively soliciting buyers could end up in the hands of the competition, instead ($20 says Workday or Oracle are already in due diligence with Paradox or Phenom).

SmartRecruiters’ Smartest Move

Now, let’s talk about the biggest surprise to emerge from these US-German negotiations: SmartRecruiters isn’t becoming SAP-only. In a statement that must’ve caused at least one legal team to spit out their coffee, SmartRecruiters committed to staying open and ecosystem-friendly:

“We will remain fully open and agnostic… continuing to integrate across ecosystems.”

That’s not just a nice-to-have. It’s a strategy.

Because SAP knows it can’t beat Workday or Oracle on loyalty. The switching costs are brutal, the procurement cycles even worse. But what it can do is sneak in the front door with a recruiting solution so good that even diehard Workday clients can’t say no.

Keeping SmartRecruiters open means SAP gets to sell into competitor accounts – without the usual HCM baggage. It’s Trojan horse strategy, only the horse is wearing skinny jeans and holding a Starbucks.

Meanwhile, SmartRecruiters gets to keep its independence, brand, roadmap, and integration stack. Everyone wins. Except, of course, to the vendors who ended up exiting to a private equity firm to be chopped up for parts.

There’s also a bit of poetic justice that a company founded by someone so stereotypically French he makes Pepe LePew seem almost Anglo by comparison was successfully annexed by the Germans.

Although, having seen that cap table, I’m pretty sure he’s still popping a bottle or two of the good Champagne today, or at least taking a break from the stealth mode reboot of SmartRecruiters he’s already assiduously building (see: Mr. Ted).

Smoking Winston: What This Means for Recruiters

The biggest concern for recruiters when these acquisitions happen is always the same: what are they going to break?

Am I going to wake up in six months and find out my favorite ATS is now a module in some overengineered HCM suite with three logins and a UI designed in PowerPoint?

Not this time.

Everything SmartRecruiters is doing right – speed, automation, scheduling, sourcing, campaigns, UX – is staying put. Rebecca Carr remains CEO. The team stays. The product doesn’t disappear into the SAP matrix.

If anything, recruiters should expect more: more integrations, faster roadmap, tighter analytics, deeper ties to core HR data. And thanks to SAP’s enterprise muscle, a lot more leverage when trying to get budget approval.

Plus, if you’re not on SAP? No problem. You can keep using SmartRecruiters, and it’ll keep playing nice with whatever systems you’ve duct-taped together already.

It’s the rare moment in recruiting tech where things might actually get better after an acquisition. I know. I’m scared too.

Das Ende: Top Talent Takeaways

On paper, this is a brilliant move. And that’s a sentence I never thought I’d write about SAP.

SAP fills a massive product gap. SmartRecruiters gets scale. Customers (theoretically) get a better experience. And for once, a major HR tech acquisition isn’t built on fluff, vaporware, or “future synergies” that only exist in pitch decks.

But we’ve been here before.

Remember when Oracle bought Taleo? Or when IBM bought Kenexa? Or when Cornerstone tried to be everything to everyone and ended up being… nothing to anyone?

Full disclosure: weirdly, I actually worked for two out of these three companies; I didn’t get a final interview at Oracle after failing my yachting assessment.

Acquisitions don’t magically fix enterprise software. They don’t solve culture problems. They don’t guarantee innovation. They give you a bigger toolbox—and then hope you don’t use it to build another monstrosity.

So yeah, SAP buying SmartRecruiters is a big deal. But it’s not a silver bullet. It’s a bet. A bet that better tech, inside a bigger company, can finally make recruiting something more than a broken process wrapped in enterprise lipstick.

Good luck. We’ll be watching. And I can’t wait to see what’s next.

Pingback: Where We’re Going, We Don’t Need Roadmaps. | Snark Attack

Pingback: Workday Buys Paradox: An Inevitable Acquisition That’s Long Overdue | Snark Attack

Pingback: When Dinosaurs Ruled: Why the OpenAI Jobs Platform Could Be An HR Tech Extinction Event | Snark Attack